0000-00

Introduction: The Global Landscape of Transformer Insulation Components Processing Equipment

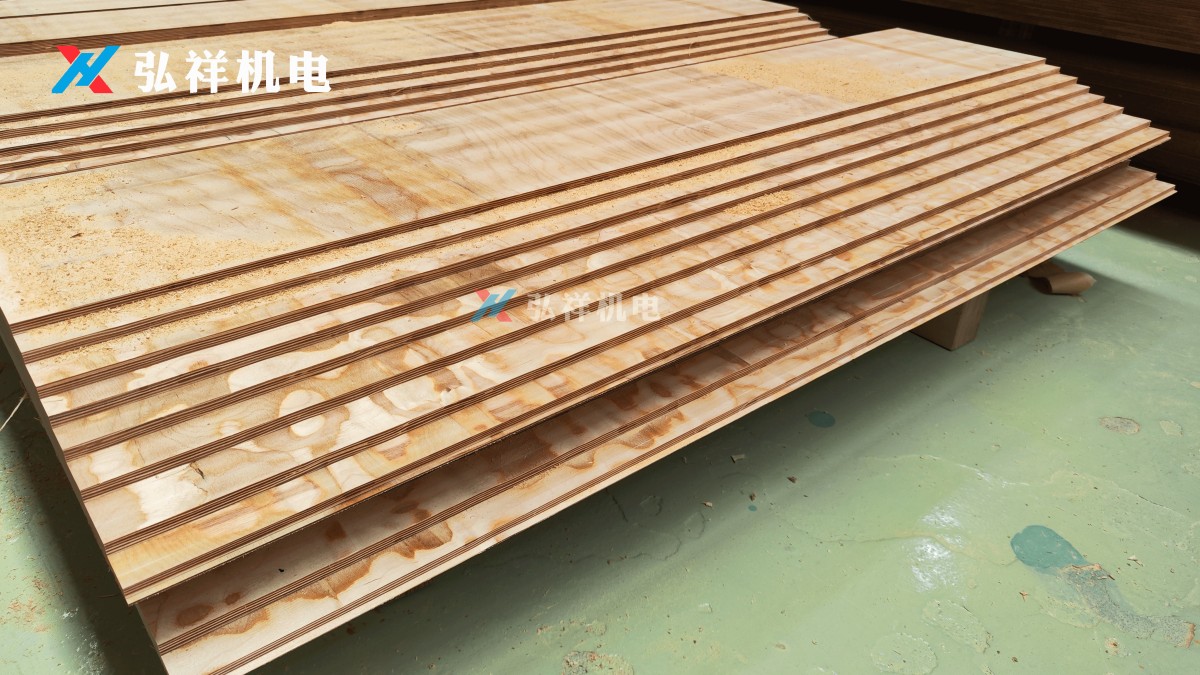

When sourcing transformer insulation components processing equipment, cost efficiency without compromising quality is paramount. This comprehensive cost comparison analyzes Chinese manufacturers like Gaomi Hongxiang against global suppliers for transformer core, electrical cardboard, and insulating parts production. Discover how China's competitive pricing, advanced technology, and customized solutions in transformer insulation parts processing equipment can benefit your operations while meeting international standards.

Key Cost Factors in Transformer Insulation Equipment Manufacturing

The production of high-quality transformer insulation components involves several critical cost considerations that differentiate Chinese manufacturers from their global counterparts. Labor costs in China typically run 30-50% lower than in Western Europe or North America, while maintaining comparable technical expertise in transformer core and insulating cardboard production. Raw material procurement for electrical cardboard and laminated wood insulation shows even greater disparities, with Chinese manufacturers benefiting from localized supply chains that reduce logistics expenses by up to 40%. Equipment maintenance and operational costs present another significant differentiator - Chinese facilities often implement predictive maintenance systems that reduce downtime by 25% compared to industry averages. These combined efficiencies allow companies like Gaomi Hongxiang to offer transformer insulation parts processing equipment at 20-35% below typical global market rates without sacrificing the precision engineering required for high-voltage applications.

Breakdown of Price Components

- Material Costs: Insulating cardboard and laminated wood materials account for 45-50% of total equipment costs in Western markets versus 35-40% in China

- Labor Intensity: Skilled technician hours required for transformer insulation parts assembly are priced at $18-25/hour in China compared to $45-65 in Europe

- Energy Efficiency: Chinese manufacturers have adopted advanced servo systems that reduce power consumption by 15-20% per unit produced

- Customization Premium: Specialized configurations for unique transformer core designs carry 10-15% surcharges with global suppliers versus 5-8% in China

Technology and Quality Comparison: China vs. Global Suppliers

Modern Chinese transformer insulation components processing equipment manufacturers have closed the technology gap with traditional Western and Japanese suppliers. Gaomi Hongxiang's production lines now incorporate German-made CNC systems for precision cutting of electrical cardboard alongside locally developed AI-based quality control systems that outperform manual inspection methods. The dielectric strength of Chinese-produced insulating laminated wood now meets or exceeds IEC 60641-2 standards, with typical breakdown voltages measuring 25-30 kV/mm compared to the 22-28 kV/mm range from European manufacturers. Automation levels in Chinese facilities have reached 75-85% for standard transformer insulation parts production, reducing human error while increasing throughput by 30-40% over semi-automated global competitors. These technological advancements, combined with rigorous ISO 9001:2015 quality management systems, ensure that cost savings don't come at the expense of performance or safety in critical power applications.

Certification and Compliance Benchmarks

Total Cost of Ownership Analysis

Beyond the initial purchase price of transformer insulation parts processing equipment, savvy procurement professionals evaluate the complete lifecycle costs. Chinese manufacturers demonstrate particular advantages in three key areas of total cost of ownership (TCO). First, the modular design philosophy employed by firms like Gaomi Hongxiang allows for 30-50% faster replacement of wear components in insulating cardboard processing units, minimizing production downtime. Second, the growing network of Chinese service centers in strategic export markets has reduced average response times for technical support to under 48 hours in Southeast Asia and 72 hours in South America - comparable to European suppliers' service levels. Third, energy consumption metrics show Chinese-made transformer core processing equipment operating at 8-12% higher efficiency than decade-old designs still common in some global facilities, yielding annual power savings of $3,500-$7,000 per machine depending on local electricity rates.

Five-Year TCO Projection (Sample 500kVA Transformer Line)

- Initial Investment: $185,000 (China) vs. $275,000 (Global average)

- Annual Maintenance: $12,000 vs. $18,500

- Energy Costs: $28,000 vs. $32,500

- Downtime Losses: $8,500 vs. $12,000

- Total 5-Year Cost: $293,500 vs. $418,000 (29.8% savings)

Customization and Scalability Advantages

Chinese transformer insulation components processing equipment manufacturers have developed exceptional flexibility in accommodating specialized requirements. Unlike many global suppliers that impose minimum order quantities of 50+ units for custom configurations, Gaomi Hongxiang and similar firms routinely handle prototype runs of 5-10 units for new insulating laminated wood designs. This agility stems from China's vertically integrated supply chains where transformer core material suppliers, electrical cardboard producers, and equipment manufacturers collaborate in concentrated industrial clusters. The modular architecture of modern Chinese processing equipment allows for field upgrades to handle new insulation materials or different voltage classes - a feature that typically adds 40-60% to retrofitting costs with European machinery. For growing operations, Chinese suppliers offer scalable solutions where additional processing modules can be integrated into existing lines at 60-75% of the cost of standalone units from traditional suppliers.

Conclusion: Strategic Sourcing for Transformer Insulation Components

The transformer insulation parts processing equipment market has reached an inflection point where Chinese manufacturers now deliver comparable quality and technology at substantially lower costs than traditional global suppliers. Gaomi Hongxiang exemplifies this new generation of Chinese electromechanical firms combining rigorous international certifications with cost structures that enable 25-40% savings across the equipment lifecycle. For procurement teams evaluating transformer core, electrical cardboard, and insulating components production solutions, Chinese suppliers warrant serious consideration - particularly for operations requiring customized configurations, energy-efficient designs, or scalable production capacity. The combination of advanced automation, localized material sourcing, and engineering expertise positions China as the value leader in transformer insulation processing technology without compromising the performance standards demanded by global power infrastructure projects.

Contact Gaomi Hongxiang Electromechanical Technology today to request a customized quote for your transformer insulation components processing needs, or to schedule a virtual tour of our advanced manufacturing facilities.

NAVIGATION

MESSAGE

Request A Quote?